Internal Revenue Service processes millions of refunds each year, and for 2026 many taxpayers are watching closely to see when their refund will be deposited and how much it might be. While the IRS does not guarantee exact dates, its long-standing processing patterns make it possible to estimate realistic refund windows and understand what speeds things up or slows them down.

How the IRS Refund Process Works in 2026

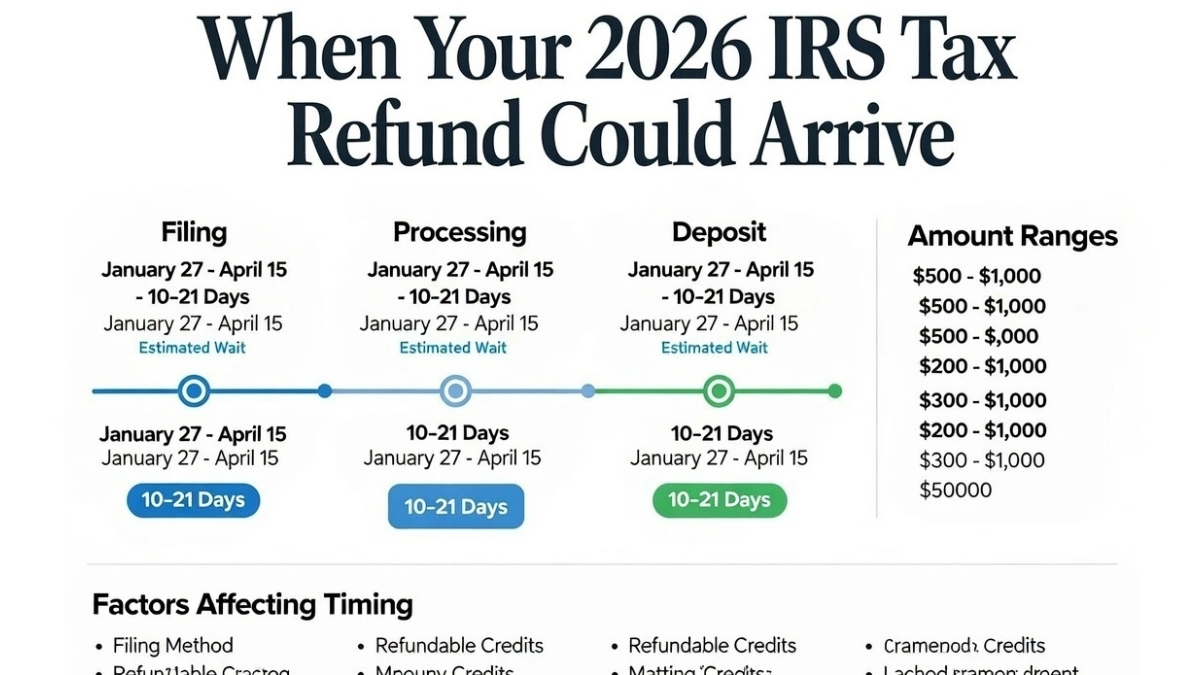

The IRS typically opens the filing season in late January. Once your return is accepted, most electronically filed refunds are issued within about 21 days. This timeline assumes there are no errors, identity checks, or credit-related holds on your return. Paper-filed returns usually take significantly longer.

Your refund amount and timing are influenced by how you file, which credits you claim, and whether the IRS needs to review your return.

Early Refund Deposits: Late January to Mid-February

Taxpayers who file electronically as soon as the filing season opens and choose direct deposit are usually first to receive refunds. For these early filers, deposits can begin arriving in early to mid-February 2026, depending on acceptance date and bank processing time.

Simple returns with no refundable credits often move through the system fastest.

Mid-Season Refund Window: February to March 2026

The majority of refunds are issued during February and March. This is when most taxpayers see their money deposited, especially those who file electronically and avoid mistakes. Refund amounts during this period vary widely, from a few hundred dollars to several thousand, depending on withholding and credits.

This period also includes many refunds that were slightly delayed due to IRS verification steps.

Refunds Delayed Until Late March or April

Some refunds are legally delayed by the IRS. Returns that include refundable credits such as the Earned Income Tax Credit or the Additional Child Tax Credit are often held until mid- to late February to prevent fraud. If additional review is needed, refunds can extend into March or April.

Errors, missing documents, or identity verification requests are common reasons for extended delays.

What Determines Your Refund Amount

Your refund amount is not random. It depends on total income, taxes withheld during the year, credits claimed, and adjustments such as education or child-related benefits. Households with dependents and refundable credits often receive larger refunds, while single filers with accurate withholding may receive smaller amounts or none at all.

There is no standard refund amount that applies to everyone.

Why Direct Deposit Matters

Direct deposit remains the fastest way to receive a refund. Mailed checks can add weeks to the process due to printing and postal delivery. Incorrect bank details are one of the most common causes of refund delays, so accuracy is critical.

Choosing direct deposit can significantly shorten the wait.

How to Track Your 2026 Refund Status

The IRS provides official tools that allow taxpayers to check refund status after filing. Updates usually appear within 24 hours of electronic filing and show whether a return has been received, approved, or sent for payment. Checking status through official channels helps avoid misinformation and unnecessary stress.

Third-party estimates are often unreliable.

Why Estimated Dates Are Not Guarantees

Even if you file early, refunds can be delayed by bank processing times, IRS workload, or compliance checks. The IRS advises taxpayers not to rely on refunds for urgent expenses until the money is actually deposited.

Flexibility and realistic expectations are important during tax season.

Conclusion: In 2026, most IRS tax refunds are expected to arrive between mid-February and late March, with some extending into April depending on credits, filing method, and review requirements. Filing electronically, choosing direct deposit, and submitting an accurate return remain the best ways to receive your refund quickly. Understanding the IRS schedule helps taxpayers plan better and avoid unnecessary worry.

Disclaimer: Refund timelines and amounts vary by individual tax situation and IRS processing conditions. This article is for informational purposes only. Taxpayers should rely on official IRS tools and guidance for confirmation.